Service? Contact Us Now

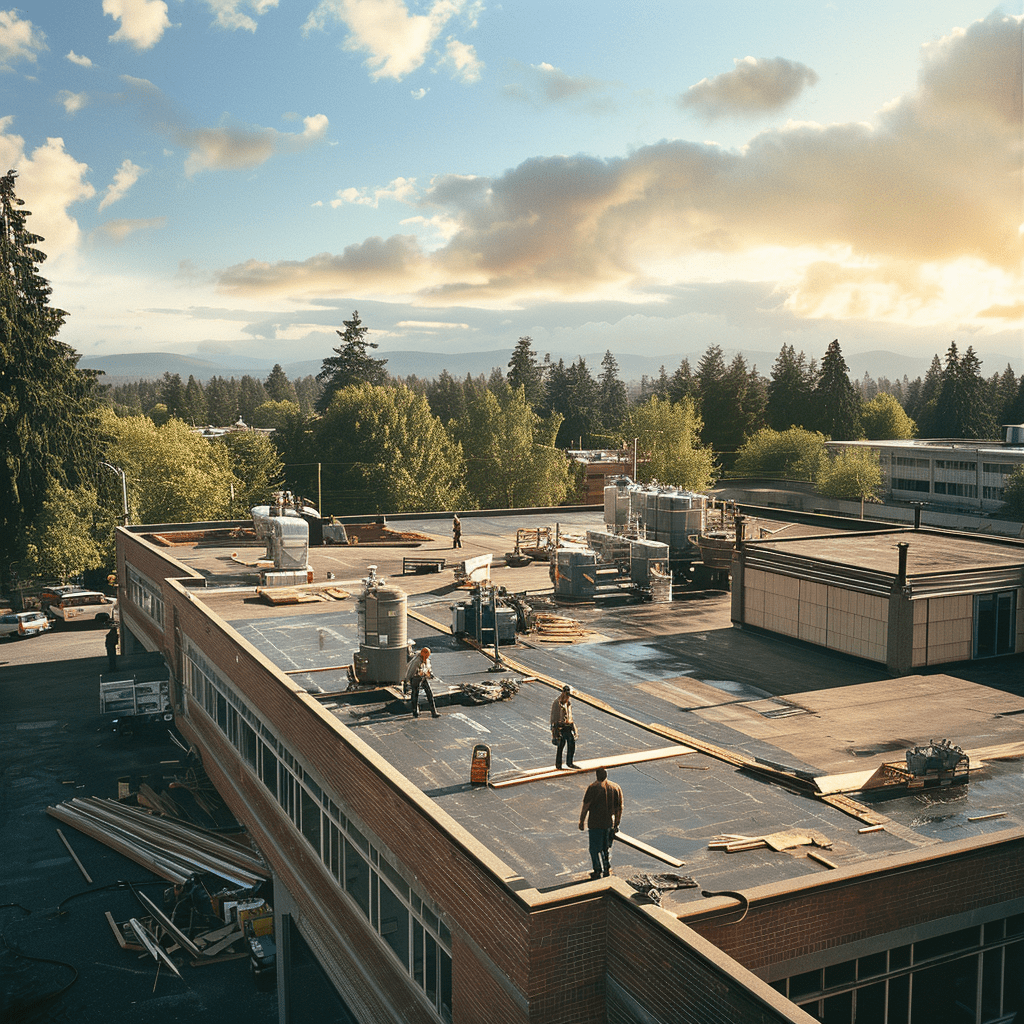

Protecting Commercial Assets in

California

Since 1991

assets covered

THE WESTERN US

Roofing Solutions for Your Building and Your Budget

Over 95% of our customers return to Highland for ongoing service and for work on their other commercial buildings. Why? Because we focus on relationships, not transactions. For us, that means understanding your needs, making an honest assessment of your current roofing system, and presenting you with the options that best serve your building, your business, and your budget. The end result is a more reliable and better performing roof, at a lower long-term cost, and enhanced peace of mind for your business.

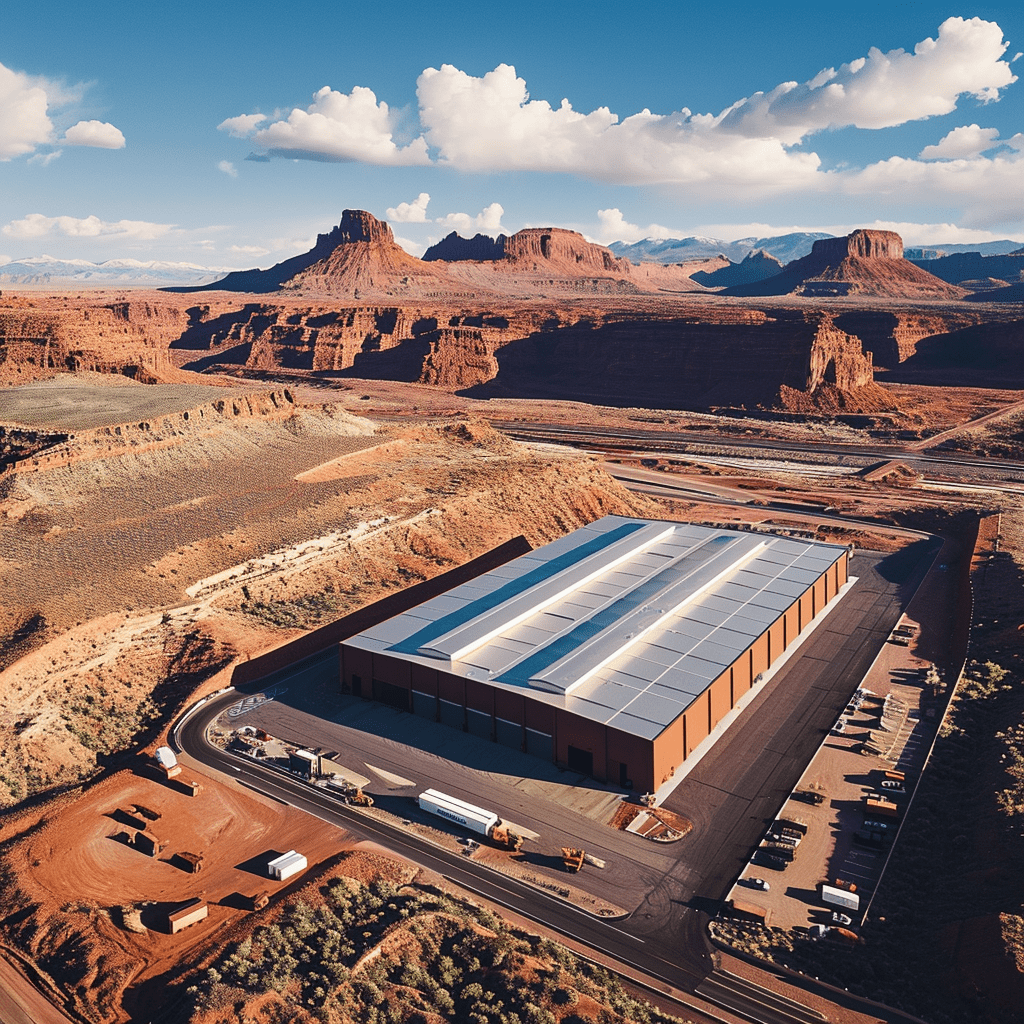

Local Service

Regional Company

Highland is a regional provider, with offices strategically located across California, Arizona, Nevada, Utah, Oregon and Washington. This regional presence allows us to provide the same level of outstanding service to customers throughout our entire service area.

Southern California | Northern California | Arizona

Nevada | Utah | Oregon | Washington | Idaho

Customer

Satisfaction is

Our Calling Card

We look out for the needs of our customers first, and it shows. As an eight-time winner of the prestigious Guildmaster Award for Service Excellence in the construction industry, and with hundreds of 5-star reviews on GuildQuality.com, Highland Commercial Roofing is one of the highest rated and most trusted roofing contractors in the business.